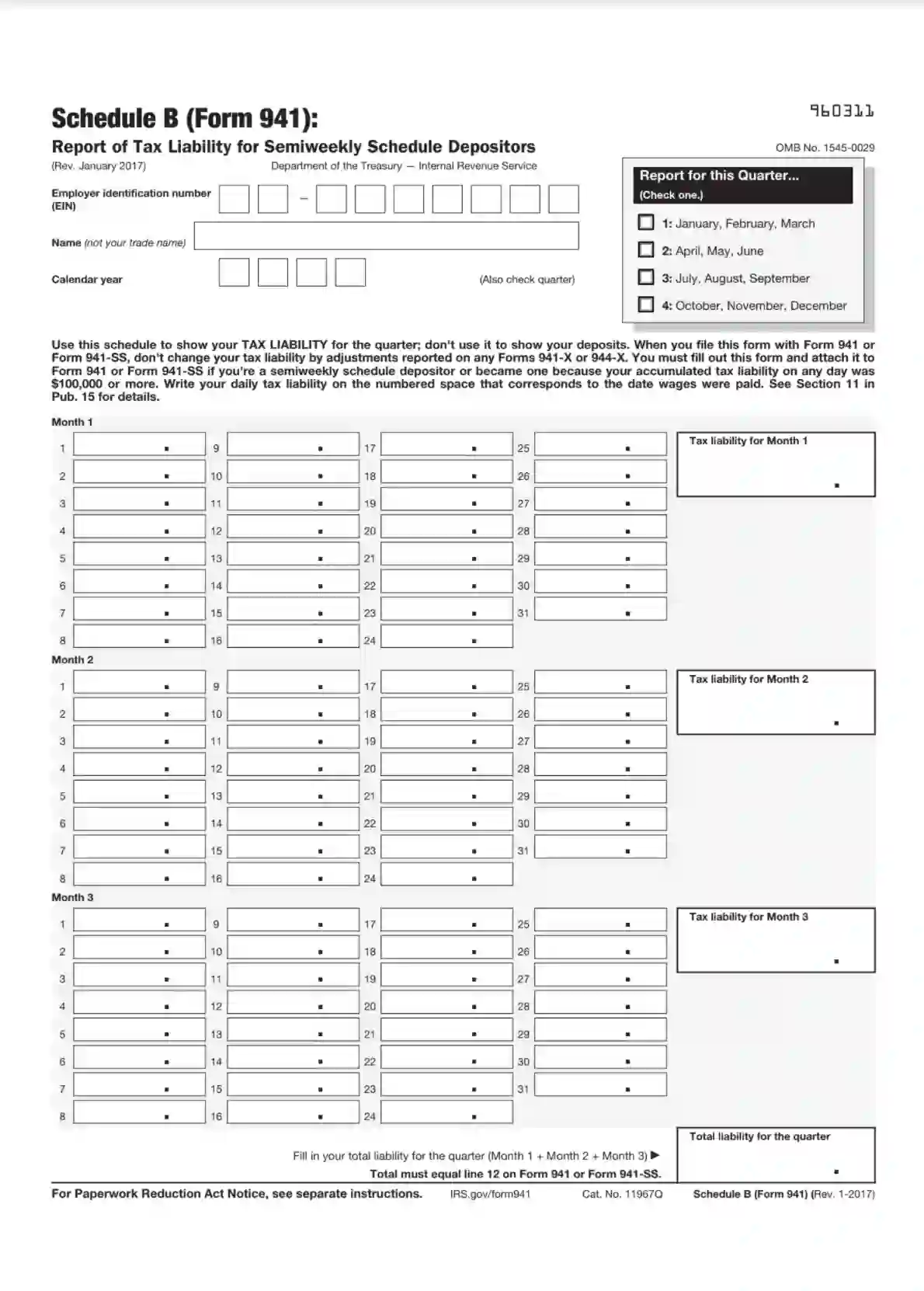

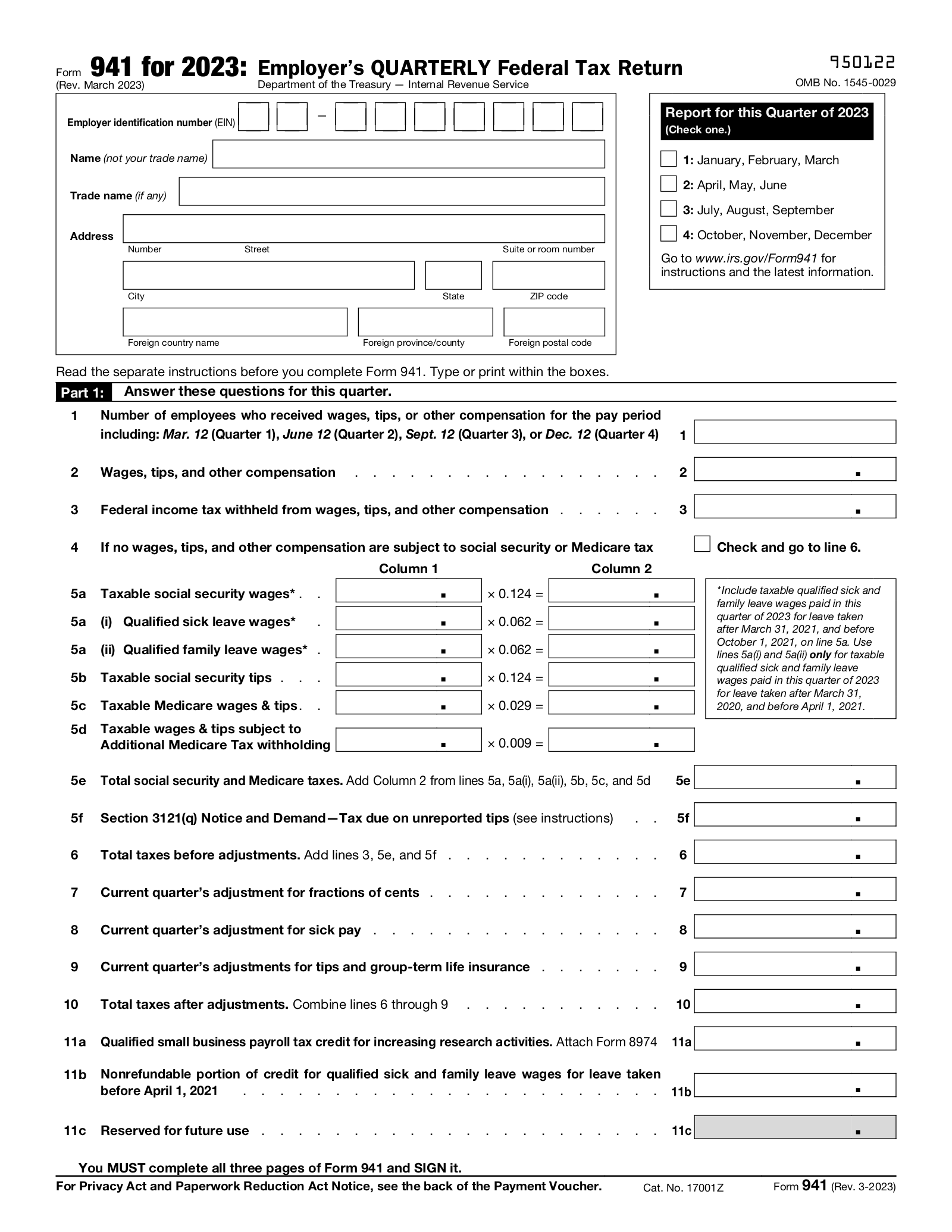

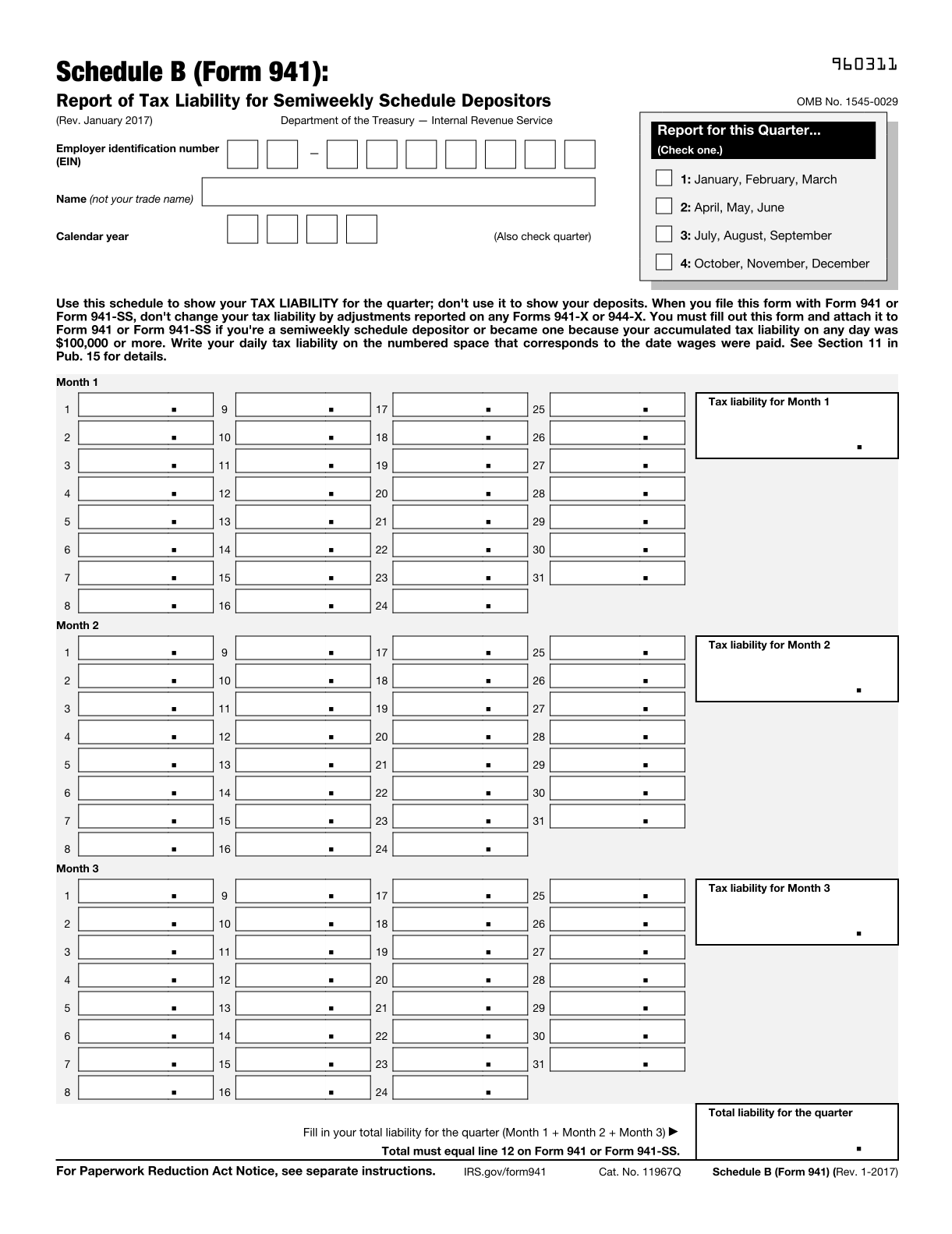

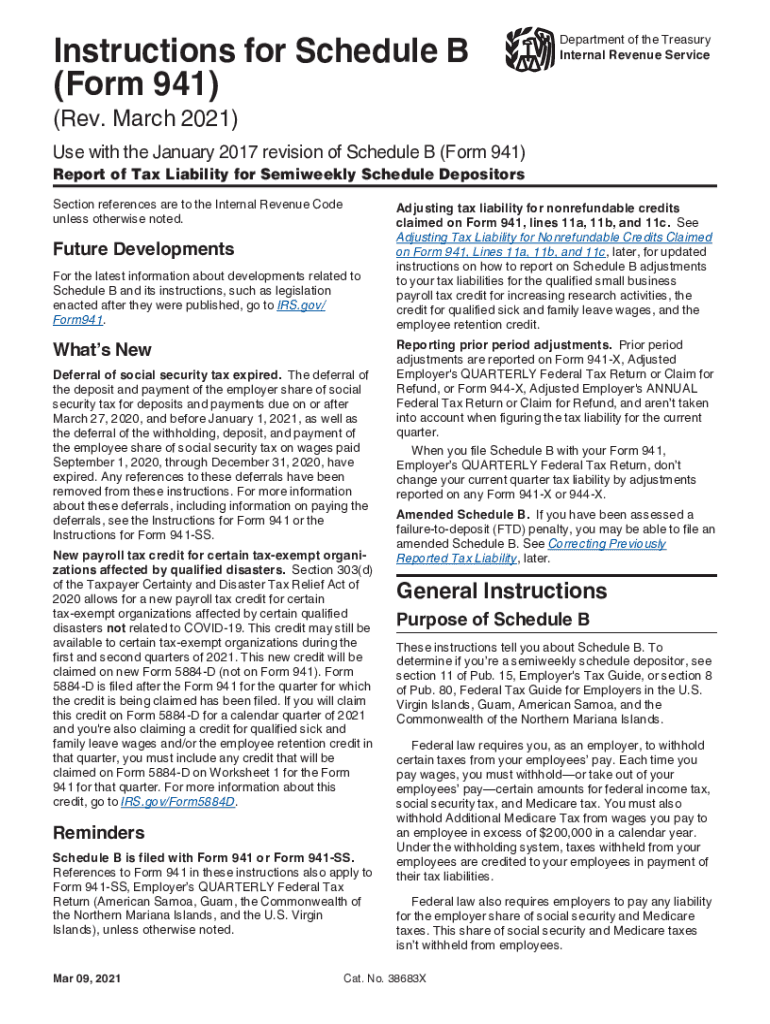

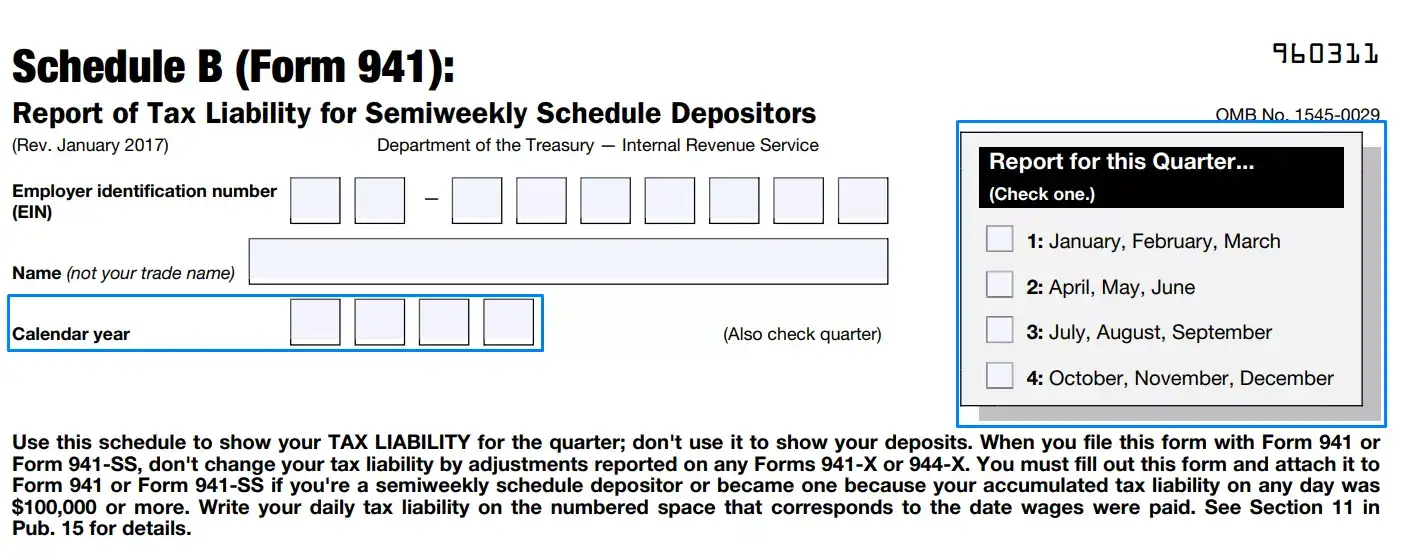

Federal Form 941 Schedule B 2024 – You pay the federal employer taxes on a quarterly basis–March, June, September and December–and submit the payment with Internal Revenue Service Form 941. You can obtain a copy of the 941 Form . Complete and submit IRS Form 941 (Employer’s Quarterly Income Tax Return) or IRS Form 943 (Employer’s Annual Federal Tax Return for Agricultural Employers must use the following schedule when .

Federal Form 941 Schedule B 2024

Source : form-941-schedule-b.pdffiller.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comForm 941: Employer’s Quarterly Federal Tax Return – eForms

Source : eforms.comSchedule B (Form 941) (Report of Tax Liability for Semiweekly

Source : hancock.inkIrs instructions schedule b: Fill out & sign online | DocHub

Source : www.dochub.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.com3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.govSemi Weekly Depositors and Filing Form 941 Schedule B | Blog

Source : blog.taxbandits.comFederal Form 941 Schedule B 2024 2017 2024 Form IRS 941 Schedule B Fill Online, Printable : Tax filers need to reference their 1099-B forms when filling out their tax returns (Form 1040) and other forms investors typically need to deal with at tax time, such as Schedule D and Form 8949. . Fines vary by charge level, with federal offenses typically more expensive than state ones. In 2022 alone, the IRS collected more than $98 billion in unpaid assessments on returns with additional tax .

]]>